Fidelity National Financial, Inc. - Company Profile

Access all 5,000+ company profiles through the Benchmarking Pro Membership. Unlock interactive competitor comparison tools that show you how Fidelity National Financial, Inc. stacks up to the competition and put relevant competitor and industry information at your fingertips.

Fidelity National Financial, Inc. - Overview

Brands

Alamo Title Company, Amerititle Downtown, Austin Title, BancServ, Barrier Island Title, Baton Rouge, Bayshore Title, Chelsea Title, Chicago Land Trust Company, Chicago Title Agency, Chicago Title Insurance Company, Commonweath, Fidelity National Home Warranty, Fidelity National Title, Fidelity National Title Agency, First National Financial, First Title, FNF Agency Operations, FNF Canada, National Title of New York

Description

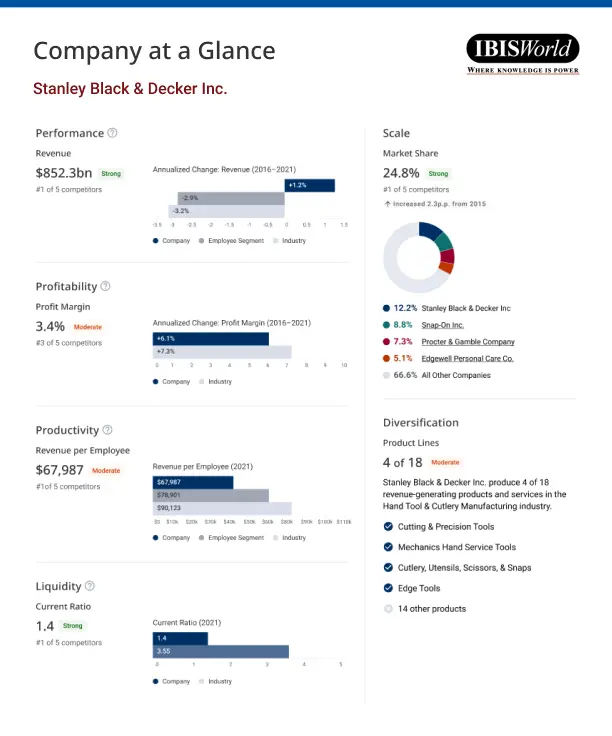

Fidelity National Financial is a public company headquartered in Florida with an estimated 23,533 employees. In the US, the company has a notable market share in at least one industry: Conveyancing Services, where they account for an estimated 22.1% of total industry revenue and are considered an All Star because they display stronger market share, profit and revenue growth compared to their peers.

Company Details

- Registered Name: Fidelity National Financial, Inc.

- Company Type: Operating

- Exchange: NYSE

- Headquarters: 601 Riverside Avenue, Jacksonville, FL 32204

- Website: https://www.fnf.com/

- Employees: 23,533

Fidelity National Financial, Inc. - Operating Industries and Main Competitors

Fidelity National Financial, Inc. - Products and Services

Conveyancing Services

Of the 5 core revenue-generating products and services in the Conveyancing Services industry, Fidelity National Financial, Inc. offers:

- Patent copyright and other intellectual property document services

- Process services

- Title search and other document filing services

- Title, abstract and settlement services

- Other

Fidelity National Financial, Inc. - SWOT Analysis

Strengths and weaknesses take into account internal factors, and are based on Fidelity National Financial, Inc.'s performance in comparison to its competitors. Opportunities and Threats focus on external influences, and are based on trends and demand in the Conveyancing Services industries

Strengths

Days Receivables: x.x%

Rank: 2 of 3 peers

Annual Turnover: x.x%

Rank: 2 of 3 peers

Weaknesses

Credit Risk: x.x%

Rank: 2 of 3 peers

Revenue per Employee: $xx

Rank: 2 of 3 peers

Opportunities

Threats

- AAAAA

- AAAAA

- AAAAA

Looking for IBISWorld Industry Reports?

Gain strategic insight and analysis on 700+ in the United States industries

(& thousands of global industries)

Fidelity National Financial, Inc. - Financial Statements

Fidelity National Financial, Inc. Income Statement

| BALANCE DATE | 12/31/2018 | 12/31/2019 | 12/31/2020 | 12/31/2021 | 12/31/2022 | 12/31/2023 |

|---|---|---|---|---|---|---|

| Revenue | 7,594.0 | 8,469.0 | 10,778.0 | 15,655.0 | 11,565.0 | 11,752.0 |

| Cost of Revenue | ||||||

| Cost of Revenue, Non-Cash | ||||||

| Gross Profit | ||||||

| 00000 |

Fidelity National Financial, Inc. Balance Sheet

| BALANCE DATE | 12/31/2018 | 12/31/2019 | 12/31/2020 | 12/31/2021 | 12/31/2022 | 12/31/2023 |

|---|---|---|---|---|---|---|

| Cash and Equivalents | 1,257.0 | 1,376.0 | 2,719.0 | 4,360.0 | 2,286.0 | 2,767.0 |

| Short-Term Investments | ||||||

| Derivative Assets, Current | ||||||

| Restricted Cash and Investments | ||||||

| 00000 |

Fidelity National Financial, Inc. Cash Flow

| BALANCE DATE | 12/31/2018 | 12/31/2019 | 12/31/2020 | 12/31/2021 | 12/31/2022 | 12/31/2023 |

|---|---|---|---|---|---|---|

| Net Income | 635.0 | 1,076.0 | 1,452.0 | 2,817.0 | 1,306.0 | 518.0 |

| Income (Loss) From Discontinued Operations | ||||||

| Depreciation, Depletion and Amortization | ||||||

| Amortization of Financing Costs and Discounts | ||||||

| 00000 |

Why purchase access to Benchmarking Pro?

This profile on Fidelity National Financial, Inc. includes:

- Company Overview

- Company Revenue and Employee Data

- Company Financial Statements

- Industry Market Share Breakdown

- Industry Competitor Matrix

- SWOT Analysis

- Products and Services

- Key Company Benchmarks

- Interconnected Competitor Profiles and Industry Reports

- Full Access to Benchmarking Pro

The IBISWorld Benchmarking Pro solution enables you to:

- Understand an enterprise’s competitive landscape and how they perform within a like-sized industry segment.

- Benchmark companies against industry averages, segment averages and their competitors.

- Identify real-world strengths, opportunities, weaknesses and threats for companies.

- Target growth opportunities or spot red flags in a business growth strategy.

- Toggle between company profiles and industry reports for a 360 degree view of a company's position.

IBISWorld provides profiles on thousands of leading companies around the world. Our clients rely on our information and data to stay up-to-date on business and industry trends across all sectors of the economy. This company profile, along with the corresponding competitor and industry data provided, includes thoroughly researched, reliable and current information that will help you to make faster, better business decisions.

Get Instant Access with Benchmarking Pro Membership

Benchmarking Pro

What's Inside

Benchmarking Pro?

A suite of company and industry data that:

- Benchmarks companies against industry averages or like-sized segments, as well as close competitors

- Identifies real-world strengths, opportunites, weaknesses and threats

- Reveals growth opportunities or red flags in a business growth strategy

Included in Report

-

Enterprise History & Synopsis

Enterprise History & Synopsis

-

Company Financial Statements

Company Financial Statements

-

Industry Market Share Breakdown

Industry Market Share Breakdown

-

Industry Competitor Matrix

Industry Competitor Matrix

-

SWOT Analysis

SWOT Analysis

-

Products and Services

Products and Services

-

Key Company Benchmarks

Key Company Benchmarks