Implementation to get your team trained and ready to start leveraging our trusted research in their daily workflows

Technical support, training on enhancements and new products, plus showing you how products like API and our Salesforce app can help your bank

Adoption of our platform so that all of your users know when, how and where to use our industry research

Liaison with our in-house analyst teams to ensure your industry research questions are answered and your team has the info they need

Prepare for client conversations and position yourself as an industry expert with our targeted call prep questions.

Prepare for client conversations and position yourself as an industry expert with our targeted call prep questions.

Create and maintain profitable relationships by building rapport with your clients and becoming a trusted advisor.

Create and maintain profitable relationships by building rapport with your clients and becoming a trusted advisor.

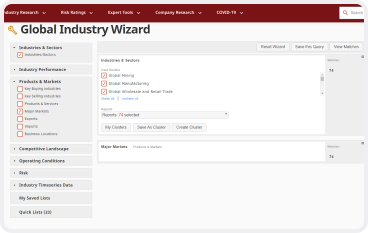

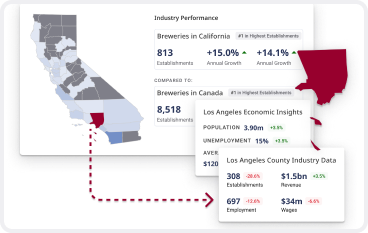

Identify opportunities for new business and understand industry concentration with local data.

Identify opportunities for new business and understand industry concentration with local data.

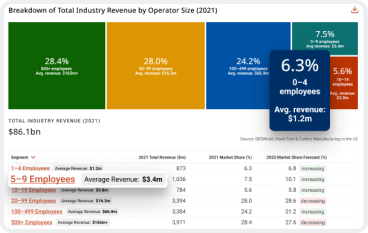

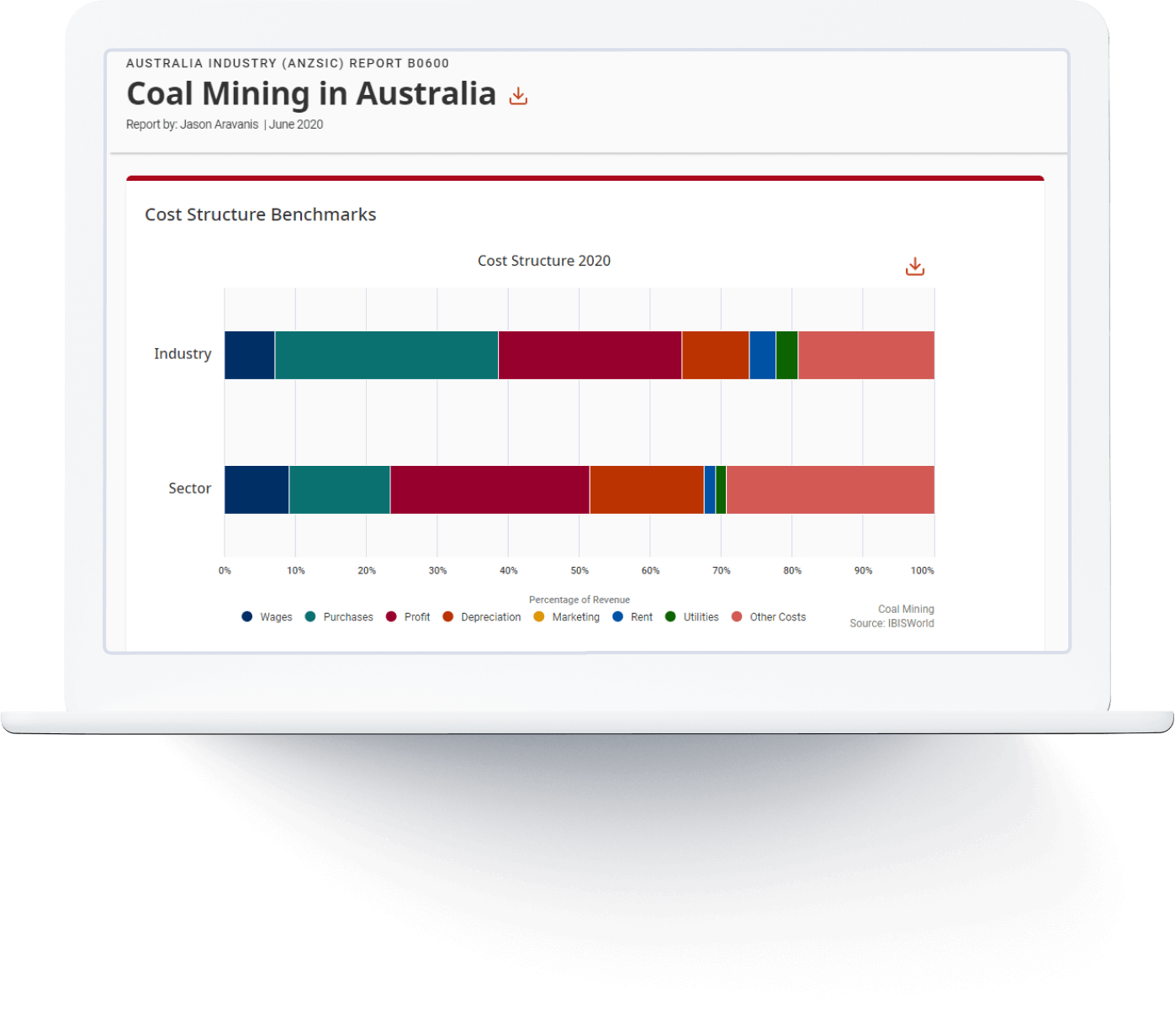

Leverage financial ratios and other key financial data and statistics to benchmark a business against the industry.

Leverage financial ratios and other key financial data and statistics to benchmark a business against the industry.

You could spend hours searching for the information that IBISWorld has at your fingertips. IBISWorld gives you far more than most resources do.

You could spend hours searching for the information that IBISWorld has at your fingertips. IBISWorld gives you far more than most resources do.

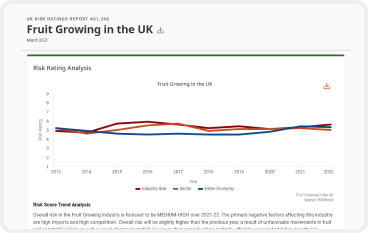

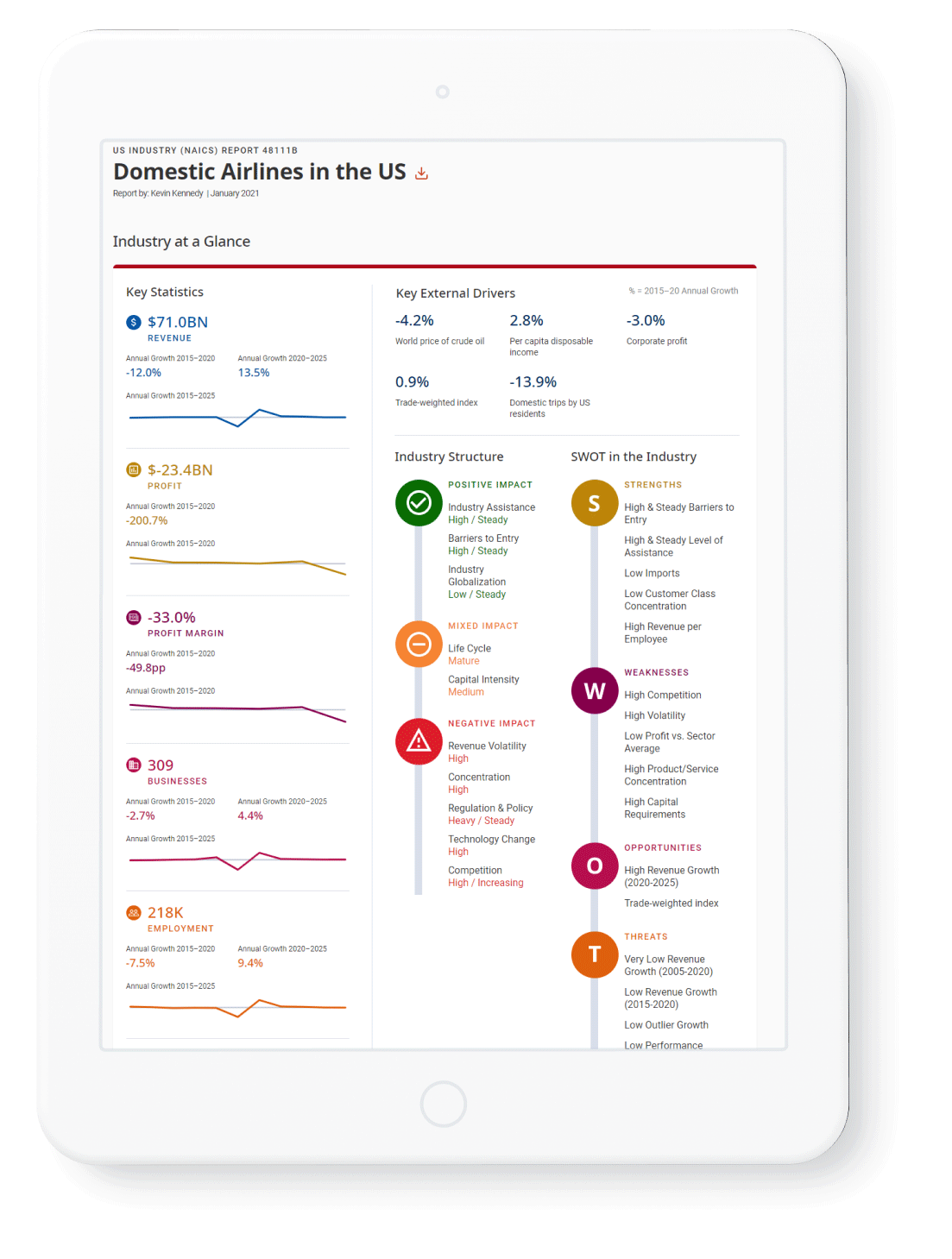

Quickly identify the risk of lending to a particular industry and understand where more due diligence is required.

Quickly identify the risk of lending to a particular industry and understand where more due diligence is required.

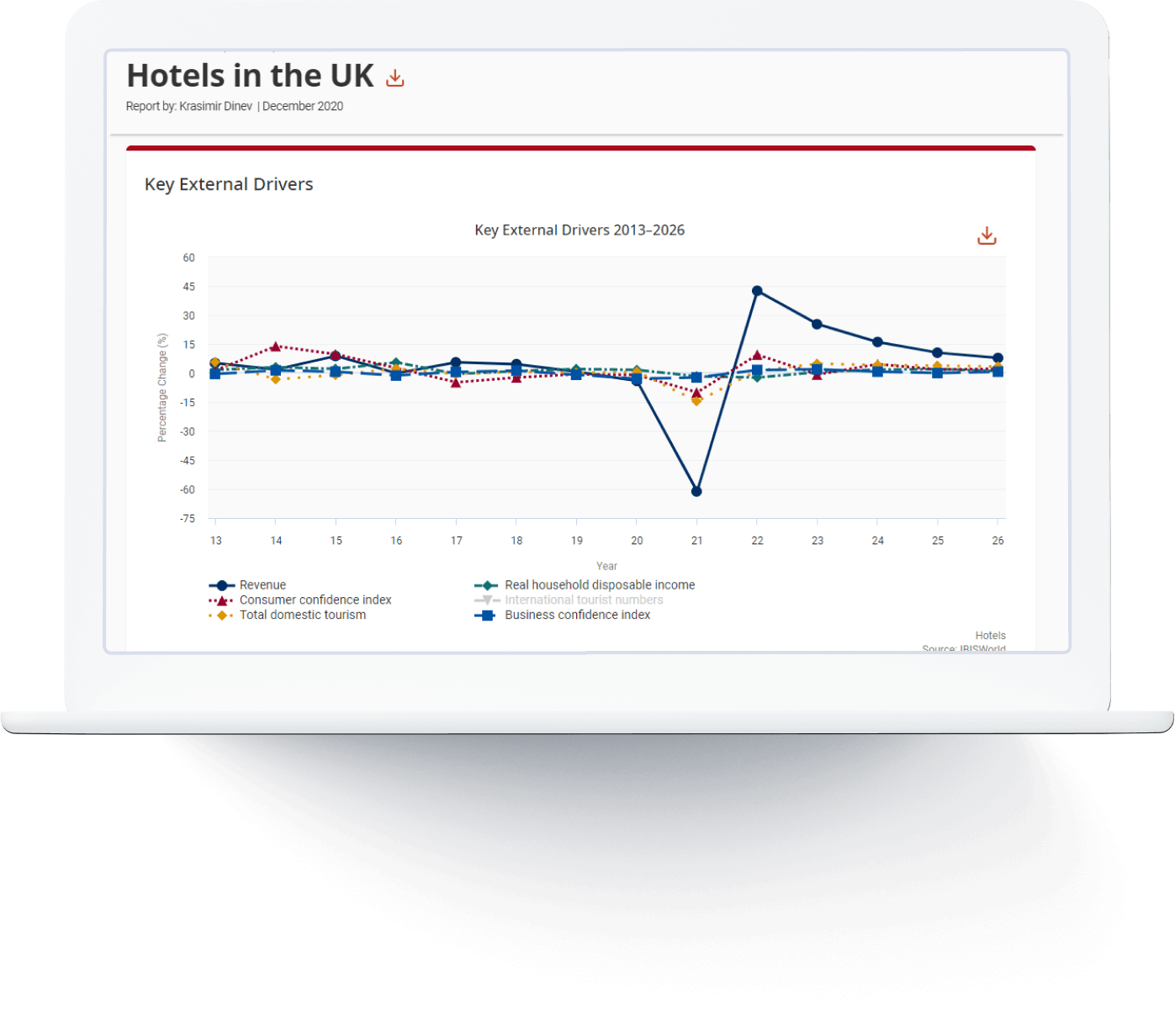

Use key external drivers to understand how outside factors positively or negatively impact a business.

Use key external drivers to understand how outside factors positively or negatively impact a business.