IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

The Shipbuilding industry in Norway has a market size of €4.3bn in 2026 with annual revenue growth of -9.2 %. Companies in this industry build ships and boats and construct floating structures. The industry also includes ship rebuilding and overhauls. Industry participants don’t manufacture parts of vessels, other than major hull assemblies.

Answer any industry question in minutes with our entire database at your fingertips.

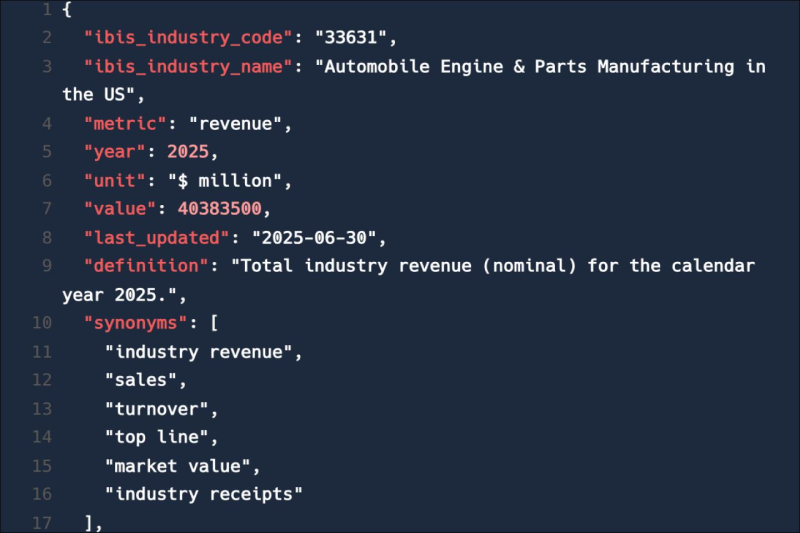

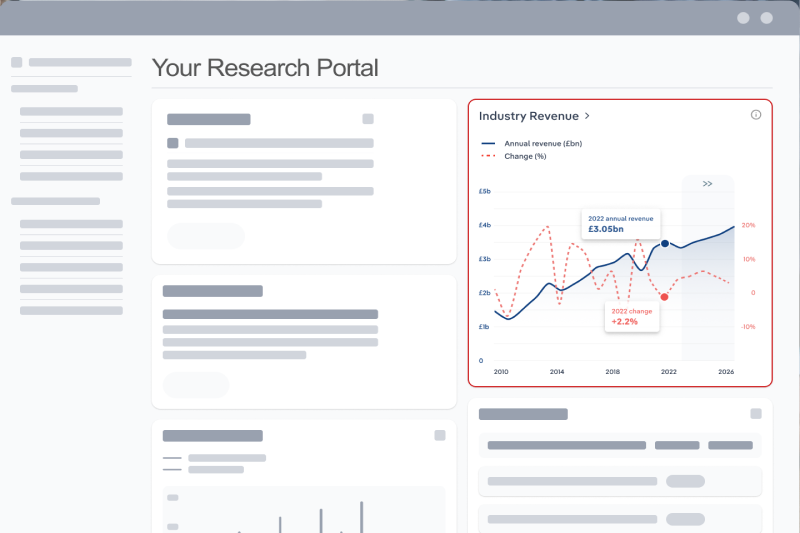

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Shipbuilding industry in Norway includes market sizing, forecasting, data and analysis. The most recent publication will be as current as of February 2026.

The Shipbuilding industry in Norway operates under the industry code NO-C3011. Companies in this industry build ships and boats and construct floating structures. The industry also includes ship rebuilding and overhauls. Industry participants don’t manufacture parts of vessels, other than major hull assemblies. Related terms covered in the Shipbuilding industry in Norway include geopolitical, refitting, offshore vessel and dredging.

Products and services covered in Shipbuilding industry in Norway include Passenger ship manufacturing , Military and other non-cargo carrying ship manufacturing and Refitting and reconstructing vessels .

Companies covered in the Shipbuilding industry in Norway include Fincantieri SpA.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Shipbuilding industry in Norway.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Shipbuilding industry in Norway. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Shipbuilding industry in Norway. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Shipbuilding industry in Norway. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Cafes and Coffee Shops industry in Australia. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Shipbuilding industry in Norway.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

The market size of the Shipbuilding industry in Norway is €4.3bn in 2026.

There are 196 businesses in the Shipbuilding industry in Norway, which has declined at a CAGR of 3.1 % between 2020 and 2025.

The market size of the Shipbuilding industry in Norway has been declining at a CAGR of 13.4 % between 2020 and 2025.

Over the next five years, the Shipbuilding industry in Norway is expected to decline.

The biggest company operating in the Shipbuilding industry in Norway is Fincantieri SpA

Passenger ship manufacturing and Military and other non-cargo carrying ship manufacturing are part of the Shipbuilding industry in Norway.

The company holding the most market share in the Shipbuilding industry in Norway is Fincantieri SpA.

The level of competition is moderate and steady in the Shipbuilding industry in Norway.