Economists, financial analysts, politicians and other gurus pronounce the likelihood of a coming recession regularly. The fact is, recessions are very hard to predict.

Nonetheless, some key economic indicators provide solid insight into whether a recession may be on the way and how it might affect certain industries. Some even boast impressive track records when it comes to predicting recessions.

Here are five recession indicators with commercial bankers in mind:

1. The US Treasury Yield Curve

Easily the most famous and touting incredible predictive power, the yield curve for US Treasury bonds aggregates thousands and thousands of forecasts into market consensus of future economic performance. It charts yields for different years of maturing.

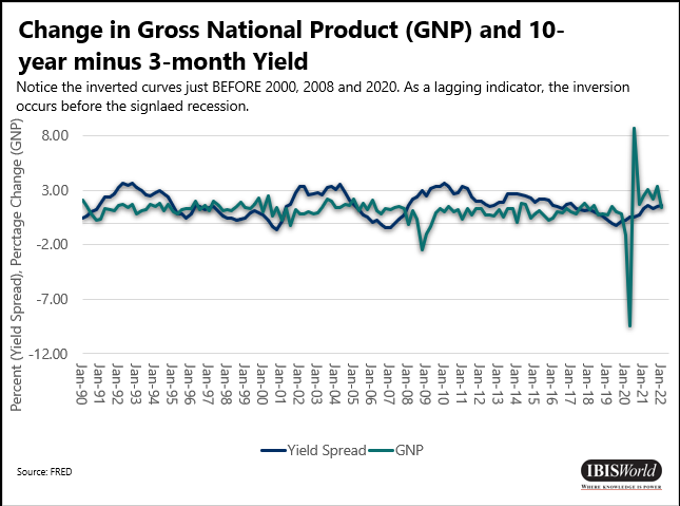

In 1989, Campbell R. Harvey discovered a strong link between the spread of 3-month yields versus 5-year and 10-year yields and changes in gross national product (GNP). The curve inverting, or short-term bonds yielding more than long-term bonds, often precedes a decline in GNP and has correctly predicted every recession since 1955.

Concerns over a possible recession lead to selling short-term bonds in favor of cash. This drives short-term yields higher than long-term yields and inverts the yield curve.

A common misconception is that the inversion of the curve between the 2-year and 10-year yields reveals market expectations for a recession. Harvey’s research points to the 3-month yield as the lower bound because it signals recession concerns in the very near term.

Additionally, the inversion must be sustained for a reasonably long period of time, perhaps as much as a quarter. Therefore, the recent inversion between 2-year and 10-year yields did not signal a coming recession.

2. Discretionary indicators

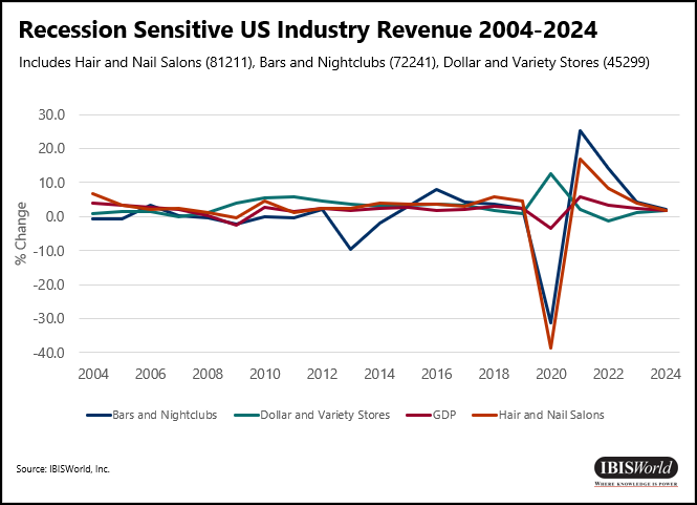

IBISWorld risk ratings and forecasts for select industries provide insights into recession risk. When consumers reduce discretionary spending, key industries experience declines in revenue.

The Hair and Nail Salons industry experiences revenue declines when consumers reduce discretionary spending. Slower overall growth can indicate a slowing economy. Beer, Liquor and Wine Stores also indicate slowdowns in discretionary spending, as do Bars and Nightclubs.

Conversely, the Dollar and Variety Stores industry may indicate an economic slowdown when trending opposite to discretionary industries. During recession years, dollar stores experience growth due to their lower-cost products.

Additionally, when macroeconomic indicators signal growth after a recession, growing discretionary industries can confirm a return to discretionary spending, consumer confidence and higher incomes.

IBISWorld’s Early Warning Risk System also highlights industries with high-risk categories and the direction of future risk. A higher prevalence of risky industries reflects analyst consensus about the future strength of the economy.

3. Personal savings rate

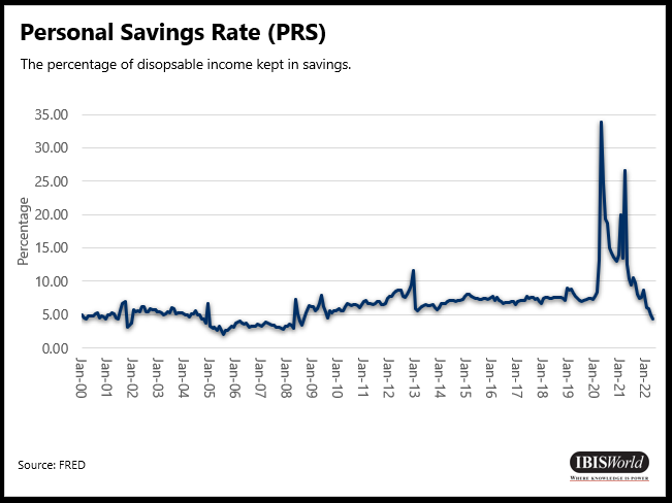

The Personal Savings Rate, reported by the Federal Reserve, indicates the percentage of disposable income saved by consumers. Following this rate describes consumers’ appetite for discretionary spending, fear levels and future expectations.

Additionally, it can highlight consumers’ reactions to changes in interest rates and even the effectiveness of the monetary policy. Consumers will typically increase savings at higher rates, with this indicator also capturing reactions to higher incomes.

Economists noted the continued rise in savings rates in 2020 despite higher incomes and spending.

The Federal Reserve found that households saved a significant portion of the first stimulus checks sent out in early 2020. The rate demonstrates a lot about household’s response to higher incomes and employment and also adds important context to possibly misleading macroeconomic trends.

To banks, a higher personal savings rate indicates lower consumer spending, but also greater availability of money for loans.

4. Delinquency indicators

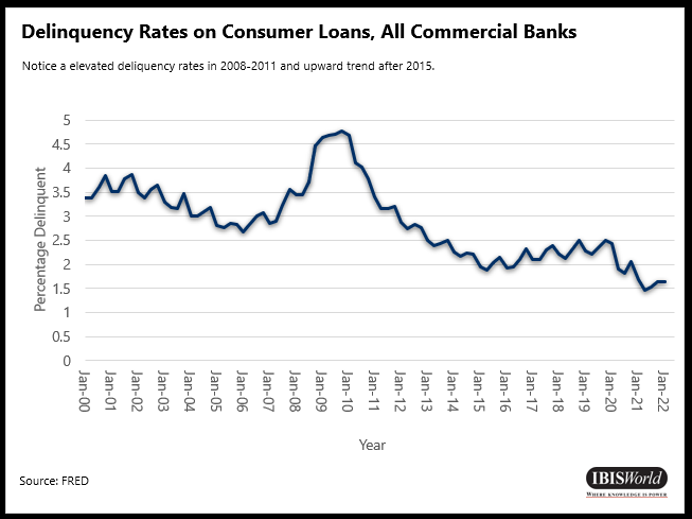

Economic contraction often leads to higher delinquency rates for loans and credit cards. Consumers and businesses with declining income may struggle to service existing debt or irresponsibly take on more to maintain living standards.

This indicates a more significant risk for bank loans, while also indicating the severity of an economic downturn.

A higher rate of people turning delinquent reveals the desperation brought on by a recession and can differentiate one downturn from another; for more information, the Federal Reserve publishes Delinquency on Consumer Loans and Delinquency on Credit Cards.

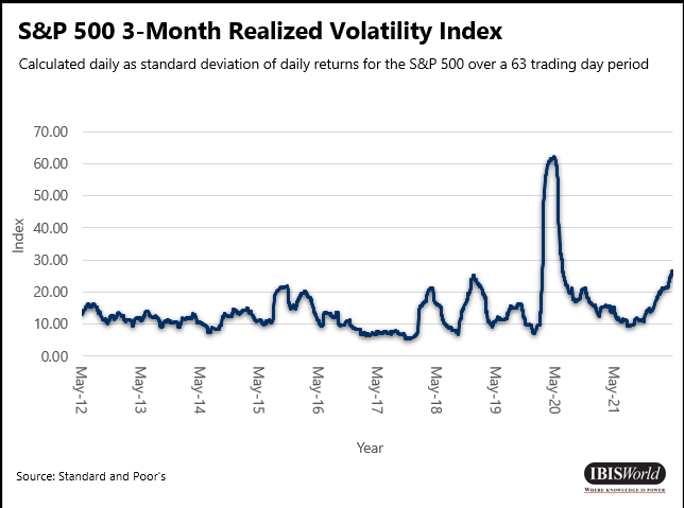

5. S&P 500 3-month Volatility Index and CBOE 3-month Volatility Index

Stock volatility indices reveal both the market’s expectation for future risk and prior risk levels, which enables comparison between past expectations and the actual realized volatility.

Stock market volatility indicates how markets expect companies offering goods and services to perform in the short term. Select groups of stocks can serve as good proxies for industry or company performance.

Using variation in stick prices, S&P 500 3-month Volatility Index reports realized risk over the previous three months for the S&P 500. The CBOE 3-month Volatility Index uses options activity to describe the market’s expectations for risk in the next three months.

Final thoughts

Predicting recessions is extremely difficult, and these key indicators can guide you while navigating periods of turbulent economic activity.

These indicators help signal the arrival of an incoming recession, providing insight into the nature of economic swings and people’s behavior. They also add context to other indicators and make sense of conflicting trends.

Most of all, these indicators give the average individual something to contemplate through trying periods of economic uncertainty.