Key Takeaways

- Industry context is frequently recreated from scratch across teams, roles, and workflows.

- The repetition is not accidental. It reflects a lack of shared, reusable structure for external insight.

- When context lives in slides and spreadsheets rather than systems, organisations cannot compound their understanding.

A meeting starts with a familiar request.

“Can we get a quick view of what’s happening in this industry?”

Someone pulls together a few charts. Another adds recent headlines. A third pastes in data from a prior deck. Within a day or two, the team has assembled a serviceable summary.

It feels productive.

The problem is that the same exercise is happening elsewhere in the organisation. And it happened last quarter. And the quarter before that.

The insight may be sound. The process is not.

The quiet repetition behind “quick context”

Rebuilding industry context rarely feels like duplication.

Each instance appears justified. The client is different. The portfolio segment is different. The engagement is different. The credit memo is different. The strategy review is different.

But beneath those surface differences, the core questions are often identical:

- How is the industry performing?

- What are the structural drivers?

- Where is margin pressure coming from?

- How does this company compare to peers?

When those questions are answered independently by multiple teams, the organisation is not learning cumulatively. It is restarting.

Why this repetition persists

Most organisations treat industry insight as background material rather than infrastructure.

It is something analysts prepare for a presentation. Something bankers reference before a meeting. Something underwriters append to a memo. Something consultants include in a slide pack.

What it rarely becomes is a shared layer of context that flows through all of those workflows.

Without that shared layer, every team builds its own version.

Not because they want to. Because they have to.

The cost is not just time

The most visible cost of rebuilding context is effort.

Hours spent pulling data. Reconciling figures. Formatting slides. Double-checking sources.

Less visible is the fragmentation that follows.

One team’s “industry growth rate” differs slightly from another’s. One forecast references last year’s driver mix. Another uses a different segmentation. A third relies on a cached spreadsheet.

Each version is defensible. None are fully aligned.

Over time, small inconsistencies accumulate. Decisions are debated not only on merit, but on whose context is “correct.”

What rebuilding looks like in practice

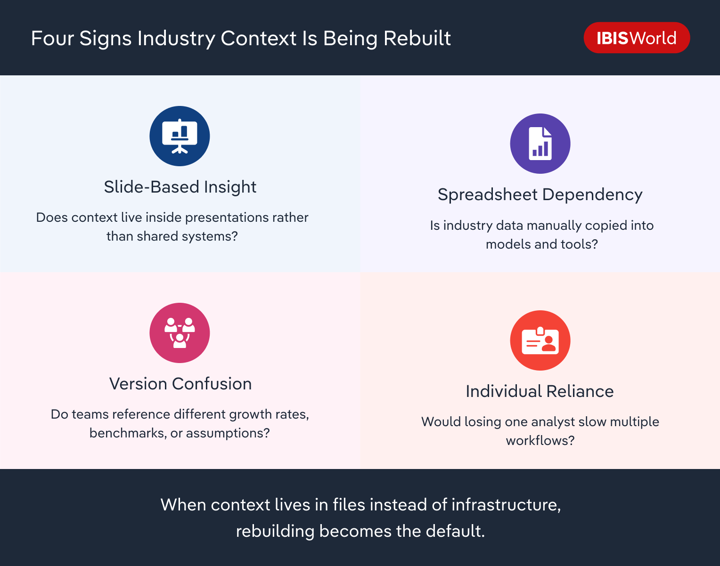

This fragmentation rarely announces itself as a workflow issue.

It looks like:

- A sales team assembling industry benchmarks for a client meeting.

- A credit team manually inserting external data into an underwriting tool.

- A consulting team creating its own market sizing model for each engagement.

- An accounting practice pulling macro indicators separately for audit and tax.

Every group believes it is doing necessary preparation.

Collectively, the organisation is duplicating effort.

Why reuse is harder than it sounds

If the problem were simply sharing files, it would already be solved.

The difficulty is that industry context is often stored in formats that do not travel well. Static decks. Isolated spreadsheets. Email attachments. Personal folders.

Context becomes attached to a moment, not embedded in a system.

When the next workflow begins, the path of least resistance is to rebuild rather than reconcile.

Rebuilding feels faster than searching for alignment.

The knowledge compounding problem

Organisations talk about institutional knowledge as an asset.

But knowledge compounds only when it is structured to do so.

If each team interprets industry change independently, the organisation does not accumulate understanding. It accumulates versions.

Over time, this creates a subtle confidence gap.

Leaders ask whether the industry outlook used in one decision is consistent with the outlook used in another. Teams spend time validating external assumptions rather than acting on them.

The more often context is rebuilt, the less certain it feels.

5 questions that reveal whether you’re rebuilding context

Most organisations do not notice duplication because it is spread across roles and time. The repetition becomes visible only when you step back and look at the pattern.

These five questions tend to expose it quickly.

1. How many versions of the industry outlook exist right now?

If sales, credit, strategy, and advisory teams would each answer that question differently, context is already fragmented.

2. Where does industry data live once a presentation ends?

If the answer is “in the deck” or “in someone’s spreadsheet,” it is unlikely to be reused consistently in the next workflow.

3. Do teams reconcile external assumptions before making decisions?

When time is spent aligning on which growth rate, margin benchmark, or driver forecast to use, duplication has already occurred.

4. Can external benchmarks flow directly into operational tools?

If industry context must be manually copied into underwriting models, dashboards, or analysis files, rebuilding is built into the process.

5. Would removing one analyst slow down multiple teams?

If institutional knowledge resides primarily with individuals rather than systems, rebuilding is not just common, it is structural.

None of these questions accuse anyone of inefficiency. They simply reveal whether industry context is being treated as shared infrastructure or as ad hoc preparation.

When the answers point toward fragmentation, rebuilding is not a one-off inconvenience. It is the default mode.

What changes when context becomes infrastructure

Teams that reduce repetition do not eliminate analysis. They redesign where it lives.

Industry insight is treated as a shared operating layer, not a presentation artifact.

That shift produces practical differences:

- External benchmarks feed directly into underwriting, portfolio, and advisory workflows.

- Sales and risk teams reference the same driver assumptions.

- Market sizing inputs remain consistent across strategy and execution.

Context stops being something assembled at the edges of a process and becomes something embedded at its core.

Why this matters more in volatile environments

When conditions are stable, rebuilding context is inefficient but tolerable.

When conditions shift quickly, the cost rises.

Manual processes lag. Teams update at different speeds. Interpretations diverge. Confidence erodes.

The organisation begins reacting not only to industry change, but to internal inconsistency.

That is when rebuilding stops being a productivity issue and starts becoming a risk issue.

Final Word

Teams do not rebuild industry context because they lack discipline.

They rebuild it because there is no shared structure to reuse.

As long as external insight lives outside core systems, it will be recreated in fragments. Each fragment may be accurate. Together, they prevent understanding from compounding.

The organisations that move faster are not those that analyse more.

They are those that stop starting over.