Key Takeaways

- Trade agreements and rising global demand will boost international trade, despite challenges from geopolitical conflicts and shifting tariffs.

- Innovations in generative AI, robotics and sustainability will drive demand as companies invest to stay competitive.

- Favorable fertility rates and migration will support economic growth in India and other industrialized nations, while labor pool challenges will curb China's dominance abroad, though it will remain a global powerhouse.

Amid challenging global dynamics, 2024 proved remarkably resilient for the world economy, marking it as a year of strong growth across numerous sectors. Despite ongoing geopolitical turmoil, the global economy beat previous expectations in 2025. International trade, innovation and population growth will foster varied growth across the world. The latest predictions from Goldman Sachs Research, the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD) expect global GDP to climb around 3.2% or 3.3% in 2025.

Key shifts in international trade, surging research and development (R&D) spending and the ongoing patterns of population migration are fundamental to understanding and making the most of this growth. These factors not only shape the 2025 economic landscape but also present strategic opportunities for businesses aiming to stay ahead. Comprehensive industry analysis remains crucial for navigating the complexities of these trends and unlocking new avenues for expansion.

Trade agreements will bolster import and export activity

International trade will play a major role in driving GDP upward in the new year. Amid heightened global interconnectivity and evolving trade agreements, the changing dynamics of export and import activities lay out some shifts among global economic powerhouses. Data from the United Nations Conference on Trade and Development indicates that the total value of world trade will reach a record high of $33.3 trillion by the end of 2025.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), a free trade agreement between 12 nations that encompasses over 15.0% of the world’s GDP, may accept new members in the coming year. The UK’s accession to the program took effect in December 2024, a change that has already begun to support global trade in 2025. The UK’s Department for Business and Trade expects this development’s impact on tariffs to bolster the nation’s economy by £2 per year moving forward.

Political tensions and the CPTPP’s stringent standards on labor, digital trade and state-owned enterprises have so far kept China and Taiwan’s applications in limbo, but new reconciliations may yet enable their participation. However, the US isn’t expected to reenter the agreement, given that President-elect Trump oversaw its withdrawal in his first term. Several nations, like the Philippines, South Korea and Thailand, have voiced their interest in joining the agreement, but their accession wouldn’t have an impact on international trade until at least 2026.

While China remains excluded from the CPTPP, it occupies a major role in the Regional Comprehensive Economic Partnership (RCEP). This trade agreement between 15 countries is the largest in the world, accounting for nearly a third of global GDP. Australia also participates in the RCEP, enabling the countries’ businesses to access buyers and suppliers in burgeoning economies in nations like Indonesia, Thailand and Vietnam. Raw material producers in these nations have access to cheap labor, making them valuable connections for Australian manufacturers looking to cut down on input costs. Several of the RCEP’s long-term agreements, established in 2022, will enter their next phase in 2025. Tariffs on manufactured goods and agricultural products are set to continue sinking toward the agreement’s 15- and 20-year goals and the continued streamlining of rules of origin, e-commerce and investment policies will provide an even larger boon for participants.

The RCEP will be especially helpful for Chinese companies seeking to continue exporting amid President-elect Trump’s new tariffs. Trump has proposed imposing a staggering 60.0% tariff on all imports from China, a move that would heavily damage Chinese companies’ ability to compete in US markets. Trump’s tariff plans don’t just include China; the president-elect has also voiced intentions to implement tariffs between 10.0% and 20.0% on all other countries.

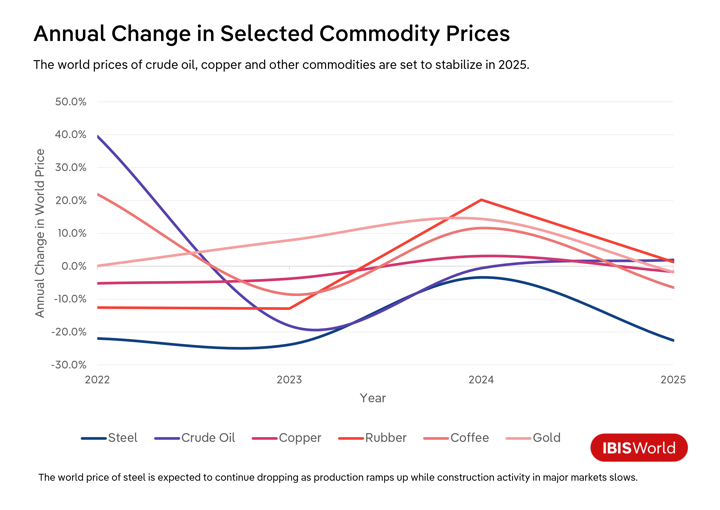

While it remains to be seen to what extent these proposals manifest, heightened tariffs may incite retaliatory tariffs and weigh on international trade in 2025. Many commodities’ prices may trend upward amid these tariffs and prolonged geopolitical conflicts, leading to inflation that will cut into consumers’ discretionary budgets and dampen demand for nonessential purchases and services. However, some economists expect other factors, like tax cuts and deregulation, to mostly offset heightened tariffs’ impact on trade.

Changes in international trade will impact industries around the world to varying degrees. In Asia, tech-driven economies like South Korea and Japan will gain even more dominance over the semiconductor export market as demand for electronic components continues to mount and changes to the RCEP and CPTPP ease barriers to trade. Meanwhile, Mexico and other countries in Latin America will capitalize on trade agreements and bilateral partnerships with the US and Canada to facilitate “nearshoring”, entrenching their position as solid options for manufacturers looking to move production to cheaper locations while avoiding hefty tariffs.

Strategies for harnessing global trade dynamics

- Adjust market entry plans by analyzing growth regions and expected trade dynamics to anticipate demand shifts.

- Reallocate resources to boost production capacity where demand is surging to enhance competitiveness.

- Increase investments in technology to optimize supply chain efficiency, which can mitigate risks associated with trade discrepancies or logistical delays as shifting policies influence trade volumes around the world.

- Take steps to bring innovative products to market, focusing on what makes products worth paying higher prices for.

Advanced innovations will incite global spending

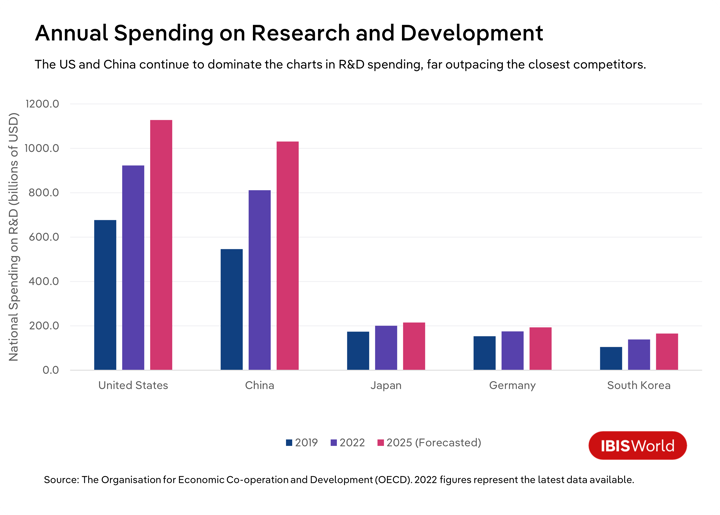

Innovation will present a major tailwind for global economic advancement in 2025. Businesses worldwide recognize the critical role that innovation plays in remaining competitive, pushing them to make strategic investments in artificial intelligence (AI), biotechnology and sustainable technologies. Using data from the OECD, IBISWorld expects companies' and governments’ spending on R&D to jump 4.4% to $2.6 trillion in 2025. Technology giants, including Apple, Alphabet and Huawei are allocating substantial budgets to R&D to bring new products to market and incite renewed demand.

Generative AI took center stage in 2023 and 2024’s R&D zeitgeist. The newest developments have enabled companies to save on labor costs and offer even more effective automated customer service and the tech companies behind models like GPT-4o, QwQ-32B and Claude 3.5 Sonnet will continue to invest in enhancing their AI tools’ results and capabilities to gain market share in the booming industry. However, the significance of advancements in 2025 remains up in the air. OpenAI has continued to delay the rollout of its GPT-5 model, which is reportedly over budget and unsure to meet the company’s goals. Still, companies will continue integrating the latest GenAI models to improve their workers’ productivity. In some cases, workers in customer service or other roles that are more easily replaced by GenAI will likely be reskilled into different positions or let go.

Robotics companies are also looking to GenAI to bring their products to the next level. Tech giant Nvidia has heavily invested in its World Foundation Models (WFMs), a type of generative AI model that helps robots and autonomous vehicles navigate the physical world. The first iteration of the platform, dubbed Nvidia Cosmos, opened for free commercial use on January 6th of this year. Roboticists will use Cosmos WFMs and other new tools to create new machines that can streamline operations for manufacturers, construction companies, agricultural businesses and many others.

New developments will bolster the world’s sustainability capabilities in 2025. Environmental start-ups like Helion continue to proliferate and many of their 2025 product rollouts will provide new routes for companies looking to monitor, report and reduce greenhouse gas emissions. From its facilities in four countries around the world, Turntide has continued to offer more powerful axial flux motors with each new product, providing a new level of efficiency and emissions reductions for machinery in a wide range of industries. Companies like Mapistry and Planet Alpha are giving businesses new ways to measure and report their carbon footprint, ensuring compliance with their nations’ regulations.

Stringent government oversight will promote these new products’ success downstream. Environmental, social and governance (ESG) regulations around the world have tightened in recent years and many new directives are set to shape sustainability in 2025. A new set of climate-related disclosure regulations in Australia and the European Union (EU) took effect on the first of the year and the US Securities Exchange Commission’s (SEC) new mandates apply to all companies with fiscal years beginning after December 15th, 2024. The EU also rolled out a new set of marine fuel regulations, forcing shipping companies to invest in new, more efficient models, costly biofuels or streamlined route planning software to avoid paying hefty fines.

The rollout of new innovations doesn’t just bring higher returns from higher prices for tech companies; it incites demand. Companies in many industries, especially those in manufacturing, are under pressure to use the most effective tools available. Their competitors may have already invested in innovative products, giving them cost-savings and quality-boosting capabilities that change market dynamics. The US Federal Reserve, the European Central Bank and other monetary authorities’ recent rate cuts have also fostered investment among commercial entities looking to reach the next level of efficiency. As these entities pause or slow their rate cuts, many businesses may see 2025 as a good time to invest in the latest in AI, robotics and sustainability.

R&D spending varies widely around the world. The US consistently leads the world in spending, which reached $923.2 billion in 2022 (latest data available). Private sector giants and substantial government backing for defense and healthcare funding drive investments in technology and pharmaceuticals in the US. China follows closely, having rapidly expanded its R&D expenditure over the past two decades as part of its strategy to shift from a manufacturing-based economy to a leader in technological innovation. China places a strong focus on AI, telecommunications and renewable energy technologies. State-owned enterprises and start-ups play a crucial role in the nation’s economy. Japan and South Korea are world leaders in electronics, automotive technology and robotics. Germany dedicates a significant portion of its GDP to R&D in automotive, aerospace, pharmaceutical and environmental technologies, placing it fourth in global R&D spending. The UK ranks in sixth place in R&D spending while Australia falls behind twelve other nations.

Strategies for harnessing innovation

- Conduct a capabilities assessment to identify areas where your business can excel in an R&D-driven market.

- Invest in internal innovation to develop products that provide end users with new capabilities or cost savings, if sufficient capital is available.

- Allocate resources strategically to hire skilled laborers with advanced degrees, ensuring your R&D efforts are well-supported despite rising wage expenses.

- Differentiate your offerings by crafting unique value propositions like convenience, interconnectivity, or sustainable production for clients.

Population growth and global migration will shift labor force dynamics and output

The longer-term and lesser-discussed economic impacts of population trends will also manifest in 2025. Population growth and migration patterns are foundational to the size of each country’s labor force and, accordingly, its economic output. Migration contributes to demographic shifts that influence labor markets, urbanization patterns and consumer behavior, presenting both challenges and opportunities for economic development.

Globally, fertility rates are on the decline. Rising levels of education and urbanization, as well as high living costs, deter adults in many industrialized nations from having children. The Federal Reserve Bank of Dallas estimates that Singapore has the world’s lowest fertility rate at just 0.95 children per woman. Fertility rates under 2.1% are considered below the nation’s replacement rate and can lead to a drop in population if not offset by immigration.

Some nations, including the US and UK, are facing suboptimal fertility rates, but their low birth rates are partially offset by net immigration. The US and UK receive 3.0 and 2.9 immigrants per thousand residents, respectively. Rising life expectancies can also offset declining birth rates, but this trend doesn’t mitigate declining birth rates’ detrimental effects on a country’s labor force. With fewer adults in the workforce, many countries are beginning to struggle to support children and retired adults.

India’s continued success and high output capacity will significantly influence the global economy in 2025. The OECD expects India’s GDP growth to outperform every other nation in the coming year, exceeding the runner-up by over a percentage point. The nation, which overtook China as the most populous country in 2023, continues to benefit from its active development and status as an emerging market economy. India’s fertility rate sits at 2.21, denoting the nation’s ability to replace retiring workers with new talent. A 2020 United Nations report identified India as the nation with the largest diaspora, with over 18.0 million Indian-born citizens living abroad. Still, India sees net immigration. Despite being the largest contributor to immigrants in the world, the US Central Intelligence Agency (CIA) reports that India saw a slight positive growth of 0.1 immigrants per 1,000 persons in 2024. As the country’s labor force continues to balloon, the country will continue upping production across many industries and expanding its footprint in the global economy.

China’s labor force is shrinking. The nation is currently facing a fertility rate of just 1.65 children per woman, largely as a legacy of its One Child Policy (1980 – 2015). China also saw net emigration in 2024, though this was only by a slim margin of -0.1 immigrants per 1,000 persons.

Still, the country’s massive investments in R&D have contributed to yearly growth in its workers’ productivity. Heightened productivity helps offset a contracting labor force by continuing to push output upward, but reports from CEIC Data and others suggest limited market entry opportunities and reallocation of investment to infrastructure are limiting its ability to improve workers’ productivity. China’s dominance in the global economy will slip in 2025 as burgeoning nations like India and Indonesia leverage expanding labor pools to satisfy demand abroad.

Global migration will play a smaller role in labor and output dynamics in 2025. Rising disposable incomes in developing nations like Bangladesh, Nigeria and the Philippines are enabling residents to seek new opportunities abroad. These workers will supplement the labor pool in many industrialized countries. Many industries around the world cite labor shortages as a significant headwind, so any growth in the number of potential hires in 2025 will help alleviate some of this burden.

According to the CIA’s published immigration rates, global migration patterns will be especially helpful for businesses in Vietnam, Canada, Switzerland and Ireland. Australia also receives 5.9 migrants per every thousand citizens, many of whom are willing to perform lower-cost jobs. Monaco, Anguilla and Luxembourg will top the charts in terms of per capita immigration, but their small economies will severely limit their impact on the global economy.

In the US, shifting border policies under the second Trump administration may lead to a marked contraction in the migrant labor pool, potentially removing up to one in eight workers in construction and agriculture industries. This initiative would drive inflation upward, incite food shortages and exacerbate housing supply issues, but it remains to be seen to what extent deportation will be carried out.

Final Word

The economic landscape of 2025 will be partially defined by transformative changes in trade, innovation and migration patterns. Businesses that embrace these dynamics through rigorous preparation and continued analysis can craft effective strategies that place them in a position to take advantage of emerging opportunities.

In an interconnected global economy, companies must remain agile and adapt to shifting trends to expand their market share and bolster their brand’s reputation. As the world turns the page towards continued economic expansion, the foresight and adaptability of businesses in navigating the shifting global currents will define their success in 2025 and the years after.